NOTE: Here’s a Special Report we provide exclusively to our Premium Access members, but we’re giving this to you absolutely free! To obtain full access to all Premium-exclusive stock recommendations, why not upgrade to Premium Access for as low as P399.00 a month?

Recommendation

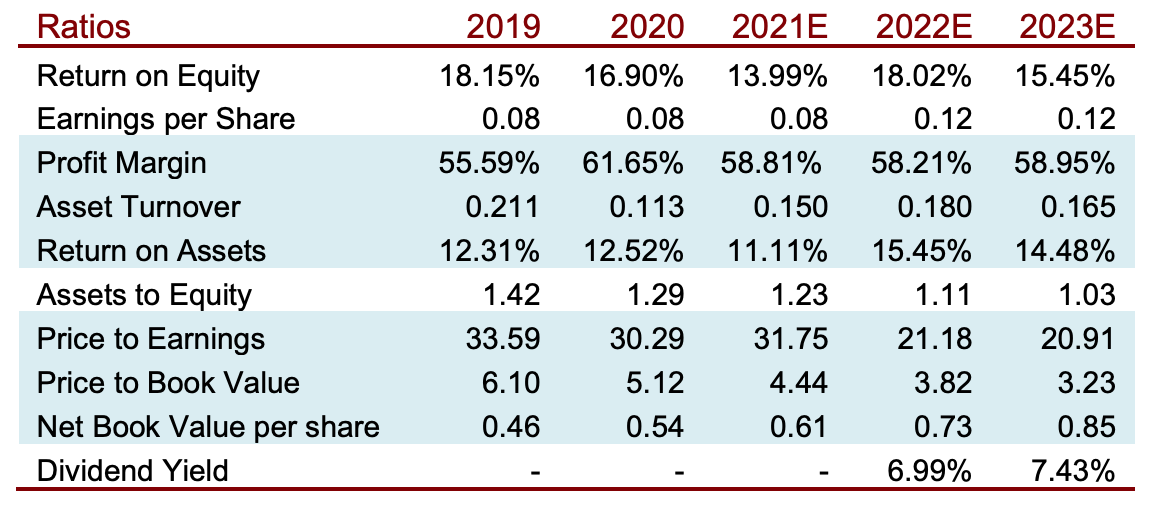

At the offer price of P2.55 apiece, CREIT’s 2022 Price-Earnings (P/E) ratio would be 21.20x. We believe that at these price levels, CREIT will be trading below its book value.

CREIT’s projected dividends offer a yield of 6.99% for 2022 and 7.43% for 2023 at the offer price of P2.55/share. These dividend yields are significantly higher than the yields of most of the currently listed REITs, beating even FILRT’s.

Analysis

Company Overview

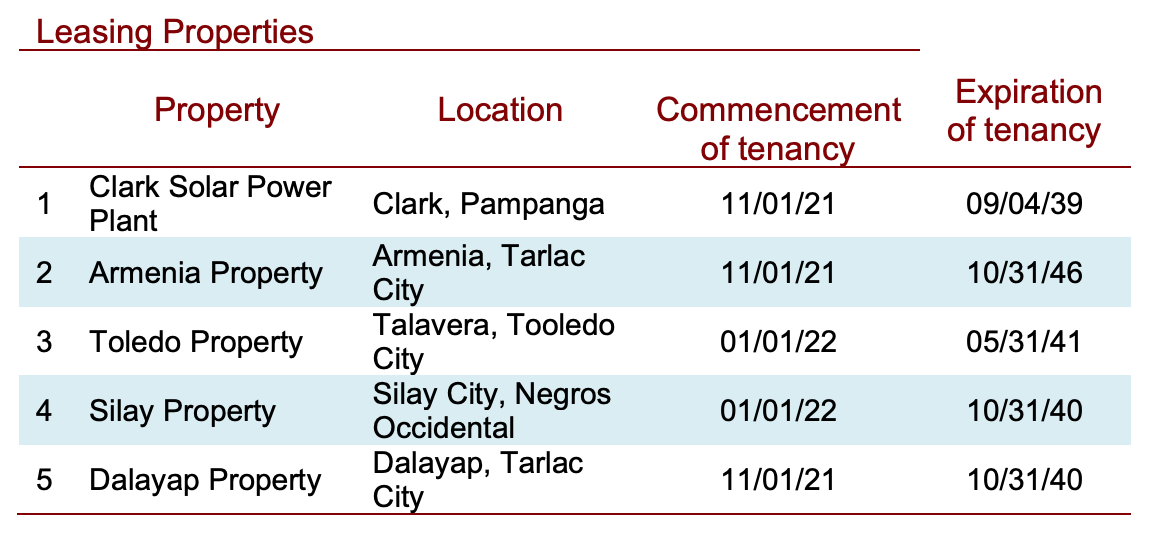

Citicore Energy REIT Corporation (CREIT), once listed, will be the country’s first ever energy REIT. What sets CREIT apart from the currently listed REITs is its purely industrial leasing portfolio. CREIT’s income stems from land lease agreements with different Citicore companies, all of which operate solar plants on the properties. Therefore, there is relatively less variability in terms of earnings versus its peers, whose rental income largely depends on tenant occupancy and contract renewals.

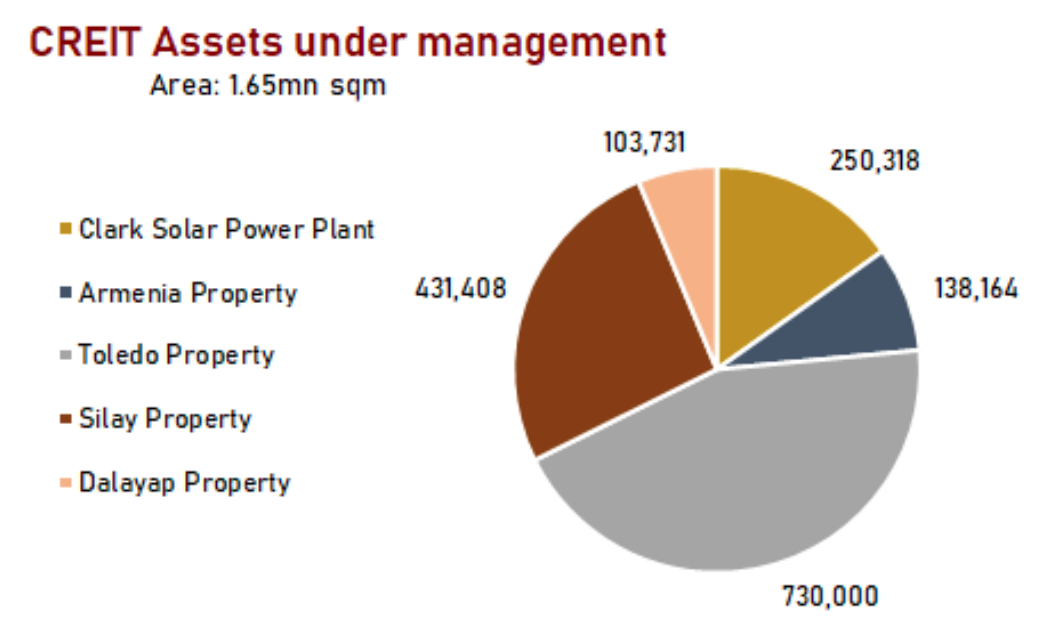

CREIT’s current portfolio consists of a solar plant with installed capacity of 22.3MW leased out to CREC, and 1.4 million sqm of land leased out to different firms belonging to the Citicore group on which they operate their plants. Out of the total contracted capacity of the properties’ solar power plants, 18.3% will expire in 2022, 9.1% will expire in 2023, 4.5% will expire in 2024, and 64.9% will expire beyond 2025.

As of end-9M21, 94% or 116.4MW of the total installed capacity of the solar power plants located on CREIT’s leased properties are contracted to TransCo and contestable customers across a diverse range of industries, and the remainder is sold under WESM.

Use of IPO Proceeds

In addition to the properties stated above, CREIT plans to expand its portfolio using its IPO proceeds by acquiring an additional two parcels of land from Citicore Bulacan and Citcore South Cotabato. These will add roughly 167k sqm of land area to its initial portfolio and bring the total to 1.99mn sqm. Note that all estimates made herewith already take into account the two additional acquisitions for 2022.

Financial Highlights

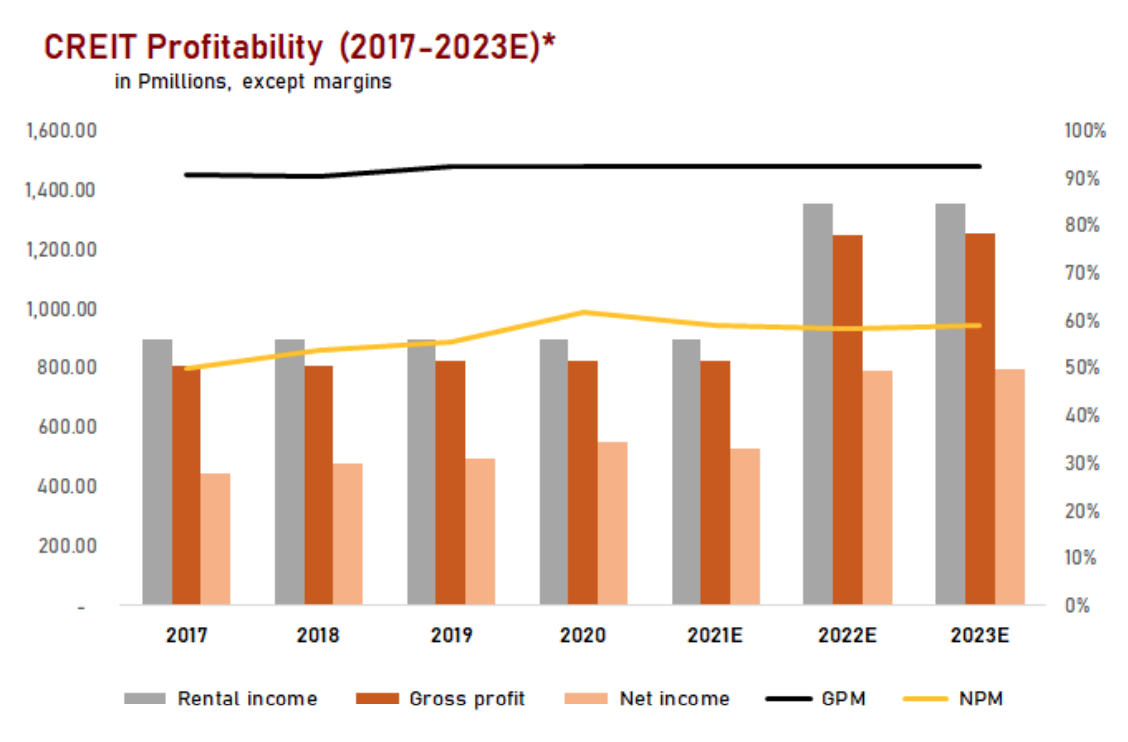

Given the nature of CREIT’s revenue stream, we expect very little variability in the firm’s profitability in the near-term. We expect stable ROE and EPS figures following CREIT’s planned acquisition of two additional properties post-IPO.

Margins are significantly high and are expected to remain that way–well above the industry average. Meanwhile, asset turnover is expected to remain above 0.15 at least until 2023E.

Also check out this other CREIT IPO Special Report!

This report is prepared by PinoyInvestor’s partner broker below. Find out more about our partner brokers and sign up to avail their complete trading brokerage services.

Commentary: US slaps PHL with 20% tariff rate, now what?