NOTE: This is a Premium-exclusive stock report, originally for our Premium Access members only, but we’re giving this to you free! To view other FREE stock reports, click here. To get full access to all Premium-exclusive reports you won’t find anywhere else, upgrade to Premium Access for as low as P399.00 a month!

Analysis and Recommendation

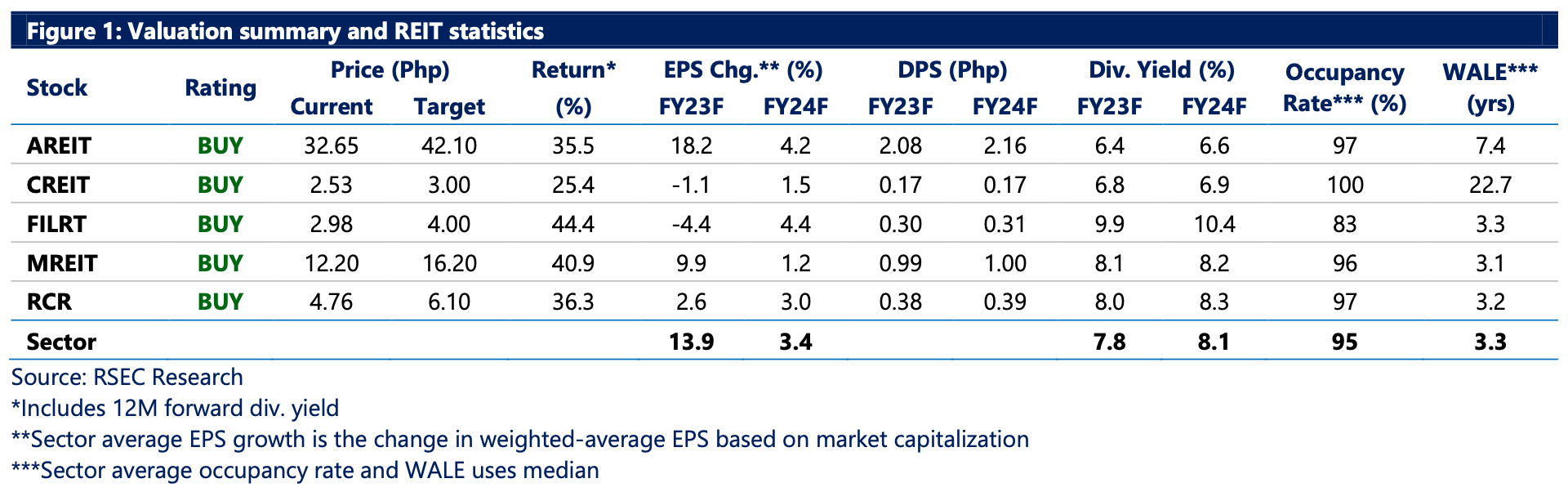

Recommend BUY on MREIT, RCR, and FILRT

Share prices of RL Commercial REIT Inc. (RCR), MREIT Inc. (MREIT), and Filinvest REIT Corp. (FILRT) dropped sharply due to flows related to the FTSE rebalancing last Friday, with RCR being deleted from the FTSE Small Cap Index and FILRT being removed from the FTSE Micro Cap Index. These brought the 2024 dividend yield of RCR / MREIT / FILRT to rise to 8.3% / 8.2% / 10.4%, respectively, all above the 10Y government bond yield of 6.4%). We reiterate our BUY rating on those three names due to bargain valuations.

RCR’s 2024 dividend yield at 8.3%

We reiterate our BUY recommendation on RCR with a target price of Php6.10 per share. RCR’s portfolio mainly comprises of offices, contributing 480.5k sqms of GLA, or 99% of total. It has a diversified tenant base with each tenant only occupying ~4% of GLA on average. Most of its tenants comprises of high-quality business process outsourcing (BPO) companies (~69% of total GLA) with minimal exposure to the POGO sector (~2% of total GLA).

Despite its heavy exposure to the office sector, we think that RCR would benefit from the potential mall infusion over the long-term. Its sponsor Robinsons Land Corp. (RLC) has 1.6mn sqms of mall GLA that are available for infusion. The potential infusion of these mall properties could provide further upside to RCR’s dividends, in-line with the long-term consumption growth.

MREIT’s 2024 dividend yield at 8.2%

We maintain our BUY rating on MREIT with a target price of Php16.20 per share. MREIT is arguably the best-in-class office REIT due to (1) its diversified tenant base, which limits the impact of tenant back-outs on MREIT’s distributable income, and (2) its superior occupancy rate of 96% (vs. Metro Manila industry office occupancy of 81%) driven by its exposure to areas with high office demand such as BGC and Iloilo.

It has huge runway for DPS-accretive portfolio expansion backed by its sponsor Megaworld Corp. (MEG), which has 1.4mn sqms of office GLA and 484k sqms of mall GLA that are ready for infusion.

FILRT is least preferred, but 2024 dividend yield of 10.4% is very hard to ignore

While FILRT is our least preferred REIT in our coverage due to its struggling office business (i.e., declining occupancy rate and falling rental rates), we think that its 2024 dividend yield of 10.4% is very hard to ignore. Management remains active in finding new tenants to fill-up vacant office spaces. FILRT will add 12,400sqms worth of new leases from BPO companies, co- working facility operators, and professional services firm, which would improve its occupancy rate by +4ppts to 87% (vs. 83% in end-2Q 2023).

NOTE: This is a Premium-exclusive stock report, originally for our Premium Access members only, but we’re giving this to you free! To view other FREE stock reports, click here. To get full access to all Premium-exclusive reports you won’t find anywhere else, upgrade to Premium Access for as low as P399.00 a month!

This report is prepared by PinoyInvestor’s partner broker below. Find out more about our partner brokers and sign up to avail their complete trading brokerage services.