NOTE: This is a Premium-exclusive report, originally for our Premium Access members only, but we’re giving this to you free of charge! To view other FREE stock reports, click here. To get full and unlimited access to all Premium-exclusive reports, upgrade to Premium Access for as low as P399.00 a month!

Analysis and Recommendation

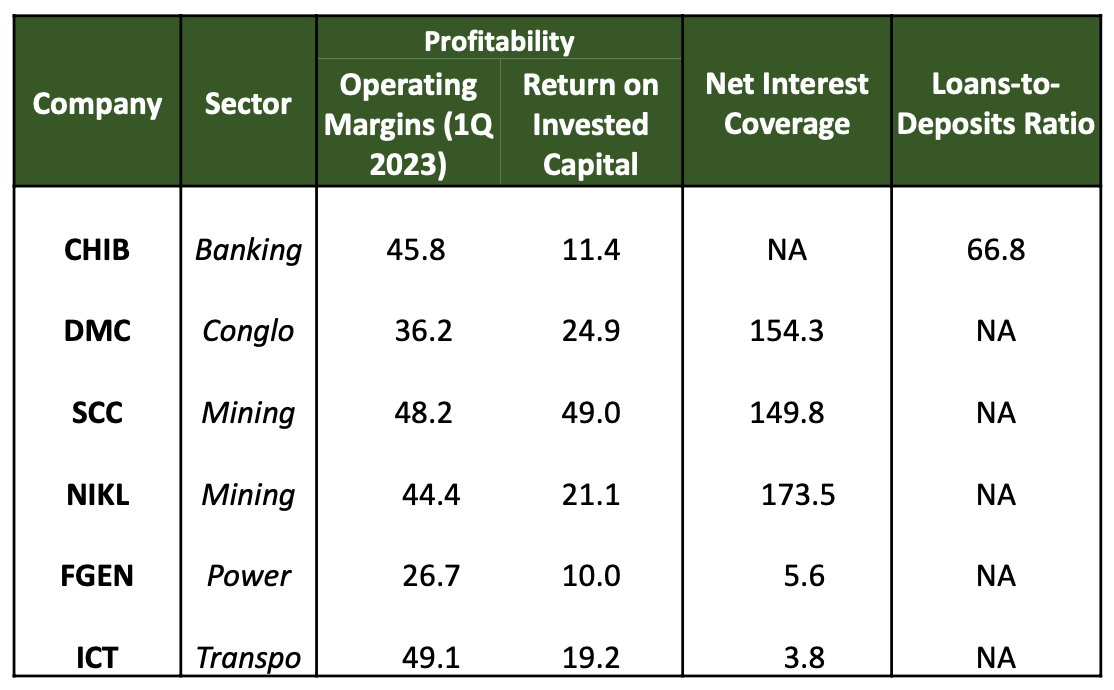

Given the still-prevalent uncertainty in the macroeconomic environment, we believe that there is merit in investing in companies with “good old fashioned healthy balance sheets and solid returns to capital”. We therefore feature stocks with strong operating margins and returns-on-invested capital (ROIC), along with stable debt ratios (see Sector Picks below).

Economic Backdrop

Inflation figures currently show a further weakening of price pressures. This should further validate the direction of BSP’s monetary policy. It is therefore likely that barring any unexpected developments in the US, BSP rates will remain at 6.25% throughout the year without anymore hikes. Rice and sugar price still remain elevated, however. On a sectoral level, this could continue to cause some pain to margins of restaurant operators.

Nevertheless, there are still risks that can cause growth to come in slower than expected, even as prices continue to ease. Sustainability of consumer spending amid prolonged higher rates may be questionable as more consumers turn towards credit-financed expenditure.

U.S. Recession Fears

On the U.S. front, data has so far given investors hope that a “soft landing” may be possible, as labor participation continues to expand while wage growth slows. Nevertheless, according to a recent survey conducted by the Conference Board, a majority of CEOs are still expecting a recession to occur in the next 12 to 18 months. Running estimates for the 1st quarter 2023 U.S. GDP are also so far showing a more sluggish level relative to historical figures.

Our Sector Picks

Banking

Steady rates actually benefits profitability. While loan repricing now has a ceiling to its upside, we note that interest income should continue to remain elevated as rates on assets settle at much higher levels versus prior years.

Furthermore, the added rate stability should actually help improve China Banking Corp. (CHIB)’s funding costs and stabilize its CASA ratio, which has seen some weakness recently. This would leave room for a potential turnaround and significant profitability growth, just in time for when other banks start to plateau.

Solid ROE should justify rosier valuations. Despite the recent downtrend in CASA, CHIB’s ROE of 14.7% remains the 3rd largest in the industry. This should therefore justify added upside in the bank’s P/B multiple.

Mining and Power

Expanding margins in mining due to elevated commodity prices. While demand from the EV industry and the energy transition to RE is likely to keep copper and nickel prices high, the same can not be said for coal in the long run.

Fuel costs for powergen is trending lower, but demand for power continues to surge. Coal and natgas prices are only slightly higher than where they were after Russia’s invasion of Ukraine started, but post-pandemic demand keeps electricity prices elevated. Things may change on the demand side once the full effect of high interest rates kick in.

Transportation

Expansion projects make ICT an intriguing buy-low candidate. Despite the cyclical nature of ICT’s business, we note that future upside remains high due to aggressive expansion in MICT (Berth 08) and VICT (Phase 3A & 3B). This should ensure heavy throughput inflow once global trade makes a comeback

ICT is able to avail of lower cost debt (evidenced by below market interest rates on obligations), which keeps overall costs of capital low. Cashflow generation also remains healthy, which allows it to stay on top of its financial obligations.

Relative to its peers, ICT is trading at a cheap EV-to-EBITDA multiple which further highlights its potential upside.

This report is prepared by PinoyInvestor’s partner broker below. Find out more about our partner brokers and sign up to avail their complete trading brokerage services.

Commentary: Impact of Israel-Iran war on PHL inflation and stock prices