Welcome and thank you for being a smart PinoyInvestor member!

As you know, PinoyInvestor is the most comprehensive source of stock market information, research reports, and analyses in the Philippines. Because of the wealth of information in PinoyInvestor, you might not know where to begin or how to use it the right way.

This is why we created this simple guide for you! Here, we’ll show you how to use each section in the PinoyInvestor Stocks Portal so you could truly make smart stock investment decisions and maximize the benefits of your subscription.

[accordion title=”Outline of the PinoyInvestor Guide”]

This guide contains four sections which discuss how you can fully benefit from PinoyInvestor. Click each header below to find out how to use PinoyInvestor!

- The Basics: Before You Start Investing

- How to Use PinoyInvestor: For Long-Term Investors

- How to Use PinoyInvestor: For Short-Term Traders

- Summary: PinoyInvestor and Applicable Time Horizon, Personal Requirements and Investment Strategy

[/accordion]

[accordion title=”The Basics: Before You Start Investing”]

The Basics: Before You Start Investing

Before we show you how to use each of the sections in the PinoyInvestor Stocks Portal, here are some important to-do’s first. Please accomplish these to ensure that you use the PinoyInvestor Stocks Portal the right way!

[subtitle3]1. Know Your Investment Objective.[/subtitle3]

Why are you looking to put money in the stock market? Frankly, “to make a lot of money” does not count as an Investment Objective. It’s obviously what we all want, but that alone is too vague to be effective.

Are you doing this for your children’s college education? Your own retirement? Or to pay for monthly expenses?

Alright, we’re getting a bit clearer. But for how long will you plan to do this via the stock market? 1 year? 5 years? 10 years? Forever?

Knowing your Investment Objective helps you set your goals, time horizon, and overall disposition. After all, if you’re investing for your retirement 40 years from now, it wouldn’t make sense to panic if the market went down this week, right?

Thus, your first step: KNOW YOUR INVESTMENT OBJECTIVE.

Read our free resource, “Know your Investment Objective” in the PinoyInvestor Academy to help you set an Investment Objective now!

[subtitle3]2. Choose Your Investment Strategy.[/subtitle3]

Now that you have an Investment Objective, it’s time to choose an Investment Strategy appropriate for it. This is because a disconnected Investment Objective and Investment Strategy won’t produce optimal returns for you.

Buy and Hold, Cost Averaging, and Market Timing are the three basic Investment Strategies that you can apply. Which one is best for you?

Know by accomplishing your second step: “Choose Your Investment Strategy”. Read these free resource in the PinoyInvestor Academy and set your Investment Strategy now!

Once you’ve done #1 and #2, you will know what to do in the stock market every time – regardless if the market is going up or down! Just keep on executing your Investment Strategy and you can be sure to reap the most optimal returns for your chosen strategy in due time!

[subtitle3]3. Never forget these key principles about independent stock trading and investing:[/subtitle3]

[list-ul type=”check”][li-row]RISKS: ACCEPT, UNDERSTAND, AND MANAGE THEM[/li-row][/list-ul]

- Investing in the stock market will always involve risk – even loss of capital!

- Invest only what you can afford to lose. Do NOT invest ALL of your savings.

- Be sure to have a cash emergency fund equivalent to at least 6 months of your monthly expenses before investing. You wouldn’t want to be forced to take money from your investment fund because: you will either lose out on future compounded gains OR WORSE, realize paper losses!

[list-ul type=”check”][li-row]STICK TO YOUR STRATEGY – NO MATTER WHAT[/li-row][/list-ul]

- DO NOT change Investment Strategies because of emotions or market sentiment. For example: If you decided on using the Cost Averaging strategy, don’t suddenly sell because the market is going down and everyone is selling. The strength of Cost Averaging lies in the increased number of shares you can buy when the market is going down! Not doing this defeats the purpose.

- Different people have different Investment Objectives and Strategies – which means different stock trades and moves apply to different investors. Be careful when accepting advice from strangers!

[list-ul type=”check”][li-row]BE THE MASTER OF YOUR OWN FATE[/li-row][/list-ul]

- Accept full responsibility for all your trades and investment decisions. Independence and responsibility are the foundations of being a great PinoyInvestor!

- Be the best stock market investor or trader you can be. Read ALL of the PinoyInvestor Academy resources freely available to you. Continuously learn. Being in the stock market may be a destination to achieve your dreams and Investment Objectives but it is every bit a journey of being better, too!

[/accordion]

[accordion title=”How to Use PinoyInvestor: For Long-Term Investors”]

How to Use PinoyInvestor: For Long-Term Investors

To maximize the PinoyInvestor Stocks Portal, long-term investors should focus on the following sections:

- Stock Rankings

- Stock in Focus

- Special Reports

These are the sections primarily based on Fundamental Analysis and, as such, may be relevant only to long-term investors. (Read more about Fundamental Analysis in the PinoyInvestor Academy.)

Short-term investors may still consider these sections but should remember that the information here are long-term in nature and may not necessarily impact their overall trading strategy.

[subtitle3]Stock Rankings[/subtitle3]

PinoyInvestor has five (5) sets of Stock Rankings to choose from:

- PSEi Stock Rankings

- Large-Cap Stock Rankings

- Mid-Cap Stock Rankings

- Small-Cap Stock Rankings

- Ranking of All Stocks

PSE index (PSEi) Stock Rankings are made up of companies that are part of the PSE index (PSEi), the market index usually considered as barometer of the Philippine economy. If you’re looking for stocks that are relatively stable and with a good historical track record, better choose PSEi stocks. These stocks are typically for investors with a long-term capital appreciation investment objective.

Our Large-Cap Stock Rankings, meanwhile, is comprised of Large-Cap stocks in the PSE, or those with market capitalization of at least PHP 100 billion. Large-Cap stocks tend to be more stable than any other categories of stocks. Many of them also pay dividends, providing additional income to shareholders. Large-caps are typically suited for investors looking for current income and driven by the goal of capital preservation. Historically, this type of stocks outperforms small-cap stocks during times of recession and bearish periods.

Mid-Cap Stock Rankings include stocks with market capitalization between PHP 40 billion and PHP 100 billion. Mid-Cap stocks are right in between Large-Cap and Small-Cap stocks and tend to be riskier than large-caps but less volatile than small-cap stocks.

Our last category of stocks is the Small-Cap Stock Rankings, comprised of stocks with market capitalization of less than PHP 40 billion. Small-Cap stocks could soon grow to become Mid-Cap or Large-Cap stocks, providing huge upsides in profit, but they are also more volatile and carry additional risk. If you’re willing to take in more risk in exchange for a possible huge price appreciation, Small-Cap stocks may be for you. Historically, this type of stocks outperforms Large-cap and Mid-Cap stocks during bullish market periods but, in recession, they also get pummelled the most.

Finally, the Rankings of All Stocks list all stocks covered in PinoyInvestor (over 80++!) according to alphabetical Stock Code. This is for those who want to see all of the Buy / Sell / Hold recommendations and Target Prices of all the stocks PinoyInvestor covers!

WHICH STOCKS TO CHOOSE? Investors are actually advised not just to hold a single category of stocks in order to diversify their portfolio and to maximize earnings. It would be better to have a good mix of PSEi, Large-Cap, Mid-Cap, and Small-Cap stocks. So depending on your overall investment objective, decide how much percentage of your portfolio you will allocate to PSEi, Large-Cap, Mid-Cap, and Small-Cap stocks!

IMPORTANT! Typically, the Average Target Prices are valid for a few months to 1 year. Do note, though, that the Average Target Prices, as determined by our partner brokers, may change instantly due to major changes in the economic environment or the company’s operations.

Thus, we encourage you to regularly monitor the Stock Rankings, and coupled with the Stock in Focus reports, make smart and informed investment choices.

Although Target Prices normally have a horizon of 1 year, if you stay true to long-term investing, you can reap more financial rewards in the future! Just to give you an example, Megaworld (MEG) used to trade at less than PHP 1.00 in 2005 and is now trading close to PHP 5.00 (as of Sep 2014)!

Target Prices may take some time before they are reached, thus, you will need to have PATIENCE. The market rises and declines as part of its regular cycle. Still, remember that there is NO GUARANTEE that Target Prices will always be reached, but you can count on PinoyInvestor to give you updated recommendations from our partner brokers when major economic and business changes impact the Target Prices of stocks.

Moreover, you might notice that PinoyInvestor’s Stock Rankings (and all other Fundamental Analysis sections like our Stock in Focus reports) do not contain a dictated “Buy Below Price” column. Nor do we have forced buy/sell orders. Why?

We understand that to be truly intelligent and independent stock investors, you must possess the flexibility to decide on your desired profit percentage and entry/exit points.

In the end, to be truly intelligent and independent stock investors, Filipinos should possess the capability to make their own smart investment decisions.

Still, if you want to be guided by a “Buy Below Price,” you can actually apply this very easily in PinoyInvestor! Simply compute the price that is, say for example, 12% lower than our Average Target Price.

For example, if our partner brokers’ Target Price is PHP 10.00, your “Buy Below Price” is PHP 8.80, computed as PHP 10.00 times the quantity (100%-12%) or, simply, 88% times PHP 10.00 = PHP 8.80.

[subtitle3]Stock in Focus[/subtitle3]

Primarily based on Fundamental Analysis, the “Stock in Focus” section shares our partner brokers’ in-depth analyses of a company and explains the rationale for a stock’s Target Price, Buy / Sell / Hold recommendation, and future prospects.

[subtitle3]Special Reports[/subtitle3]

PinoyInvestor’s Special Reports cover our partner brokers’ analysis and opinion on various topics that affect the stock market. These may be sector reports, economic updates, upcoming IPOs, and more!

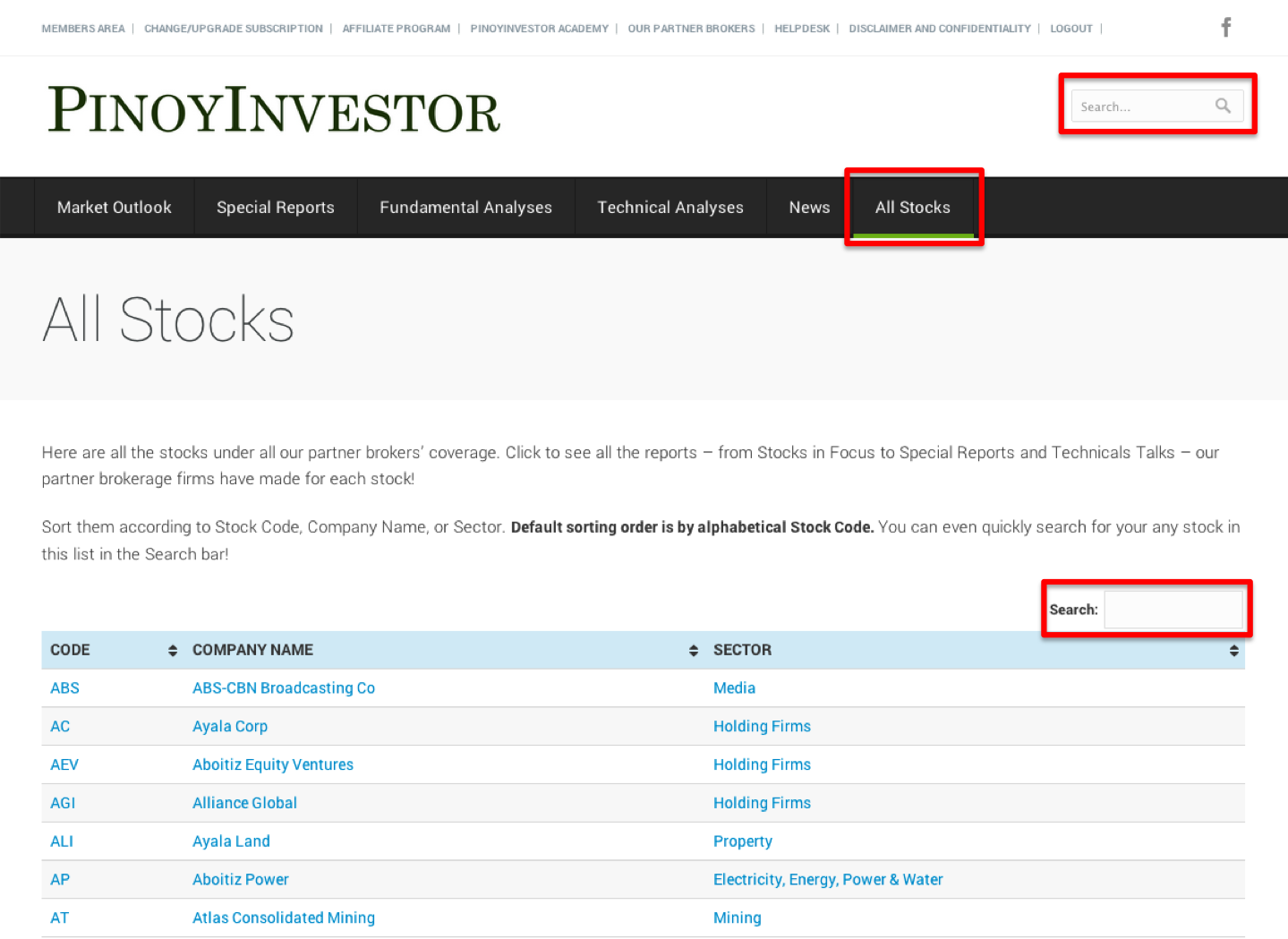

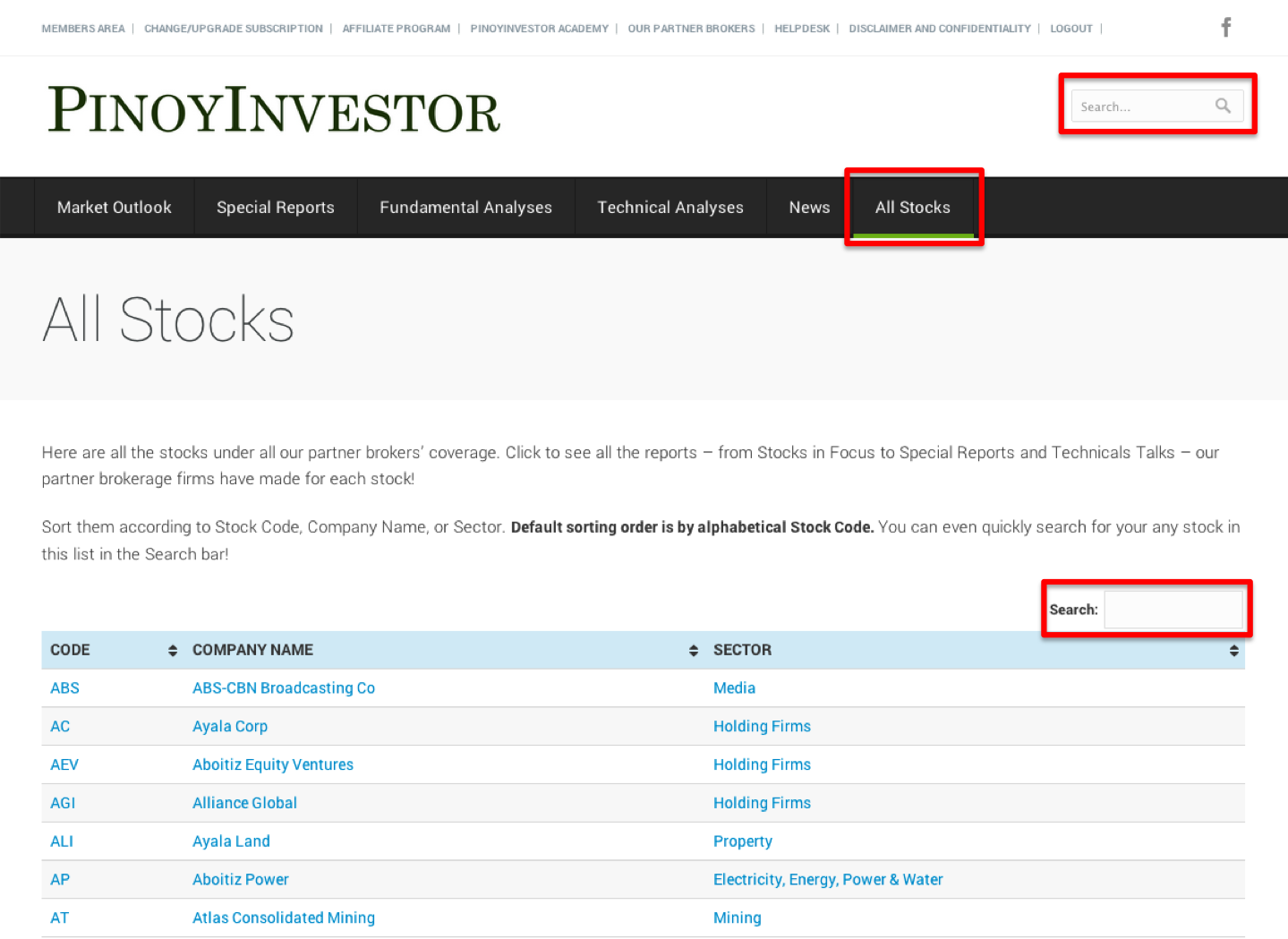

Lastly, to see these types of reports for specific stocks, don’t forget that each stock in PinoyInvestor’s coverage has its own dedicated stock page!

You can search for them OR you can go to our “List of All Stocks” page to see the dedicated page for your preferred stock!

See how Jollibee Foods Corporation’s (JFC) dedicated stock page looks:

[/accordion]

[accordion title=”How to Use PinoyInvestor: For Short-Term Traders”]

How to Use PinoyInvestor: For Short-Term Traders

For short-term traders to maximize the PinoyInvestor Stocks Portal, they should focus on the following sections:

- Technicals Talk

- Market Outlook

These sections are primarily based on Technical Analysis (know what Technical Analysis is in the PinoyInvestor Academy). As such, they may be relevant only to short-term traders.

Long-term investors may still consider these sections but should remember that the information here are short-term in nature and may not necessarily impact their overall investing strategy.

[subtitle3]Technicals Talk[/subtitle3]

The “Technicals Talk” section summarizes our partner brokers’ technical analysis – including support, resistances, patterns, etc. – of select PSE stocks. Technical Analysis relies on trends and price movements and is typically used for short-term trading.

Again, if you’re a purely long-term investor, take note: You should not be even looking at the Technicals Talk section. As we have always explicitly stated, this section is only for people with a short-term trading orientation (e.g. daily or weekly trading activity) and it obviously does not coincide with long-term investing objectives!

[subtitle3]Market Outlook[/subtitle3]

The daily Market Outlook highlights our partner brokers’ Technical Analysis of the PSEi (showing its expected movement) for the coming days.

Lastly, to see these types of reports for specific stocks, don’t forget that each stock in PinoyInvestor’s coverage has its own dedicated stock page!

You can search for them OR you can go to our “List of All Stocks” page to see the dedicated page for your preferred stock!

See how Jollibee Foods Corporation’s (JFC) dedicated stock page looks:

[/accordion]

[accordion title=”Summary: PinoyInvestor and Applicable Time Horizon, Personal Requirements and Investment Strategy”]

Summary: PinoyInvestor and Applicable Time Horizon, Personal Requirements, and Investment Strategy

The most important thing that you have to remember when using PinoyInvestor is this: different sections in PinoyInvestor serve DIFFERENT purposes and are, thus, for DIFFERENT people.

We cannot stress this enough. These different sections have different requirements, time horizons, and Investment Strategies as summarized below.

| Section | Time Horizon | Personal Requirements | Applicable Investment Strategies |

|---|---|---|---|

| PSEi and Large-Cap Stock Rankings | Long-term (usually at least 5 years) | Patience | Buy & Hold / Cost Averaging |

| Mid-Cap and Small-Cap Stock Rankings | Short-term | Risk-taking | Market Timing |

| Stock in Focus Reports | Long-term (usually at least 5 years) | Patience | Buy & Hold /Cost Averaging |

| Special Reports | Long-term (usually at least 5 years) | Patience | Buy & Hold /Cost Averaging |

| Technicals Talk Reports | Short-term | Trading Plan | Market Timing |

| Market Outlook | Short-term | Trading Plan | Market Timing |

We hope you see this as a useful guide to make smart and profitable stock investment decisions!

Happy trading and investing!

[/accordion]